Companies (Share Capital and Debentures) Third Amendment Rules, 2016

NEW RULES BECKONS START- UPS!!!

The Ministry of Corporate Affairs issued a Notification on 19th July, 2016 amending the erstwhile Companies (Share Capital and Debentures) Rules, 2014. The New Rules, inter alia set out the procedure for issuance of shares and debentures, disclosure and filing requirements, and other compliances. The Amendment modifies rules relating to the issue of shares (including by start-ups), pricing, and creation of security within group companies for secured debentures. The New Rules is a step forward towards ease of doing business in India.

In exercise of the powers conferred under sub-sections (1) and (2) of section 469 of the Companies Act, 2013 (18 of 2013), the Central Government made the following changes to the Companies (Share Capital and Debentures) Rules, 2014;

Birth of New Rule 4(1)(g):

The earlier Rule 4(1)(g) was stringent barring defaulting companies from issuing equity shares with differential rights at any point of time. Now a company may issue equity shares with differential rights upon expiry of five years from the end of the financial year in which such default was made good.

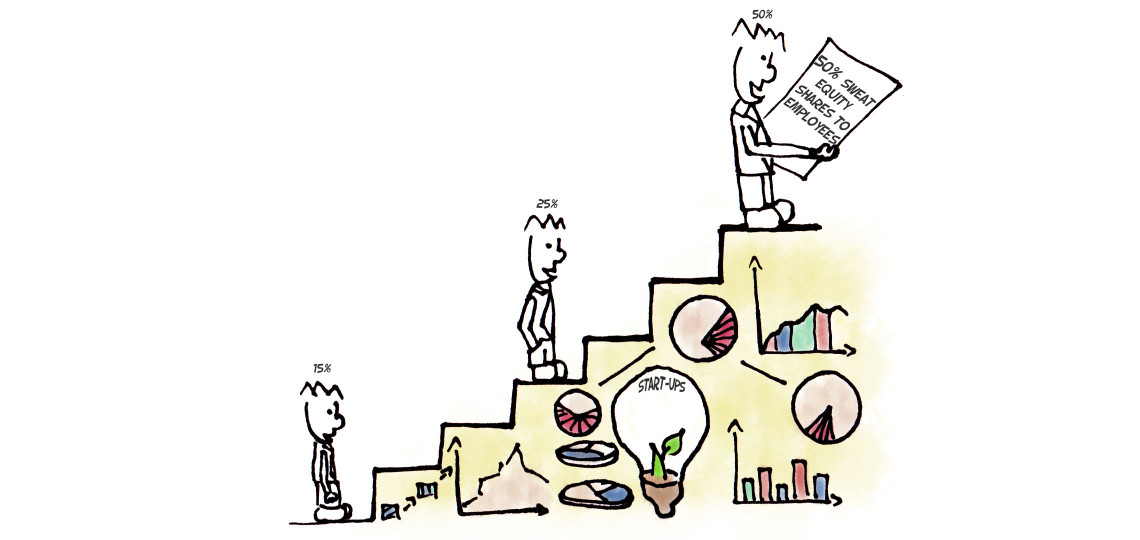

Start Up India – Stand Up India:

A new provision has been added to the existing Rule 8(4). The new rules permit Start Up Companies as defined by the Department of Industrial Policy and Promotion (DIPP), Government of India 1, to issue sweat equity shares upto 50% of the paid up share capital for a period of five (5) years from the date of its incorporation or registration.

As per DIPP Notification the following entity may be considered as a Start up:

a) From the date of incorporation/registration, up to five years;

b) If its turnover for any of the financial years has not exceeded Rupees 25 crore, and

c) It is working towards innovation, development, deployment or commercialization of new products, processes or services driven by technology or intellectual property;

Provided that any such entity formed by splitting up or reconstruction of a business already in existence shall not be considered a Start Up.

Employee Stock Options:

Rule 12(1)(c) has been amended by nullifying the effect of Sub- Clause (i) and (ii) for a period of five (5) years for Start Ups from the date of its incorporation or registration. This will enable Start Ups companies to issue Employee Stock Options to its employees which includes the following:

- An employee who is a promoter or a person belonging to the promoter group; or

- A director who either himself or through his relative or through any body corporate, directly or indirectly, holds more than ten (10) per cent of the outstanding equity shares of the company.

Issue of Shares on Preferential Basis:

- The existing Rule 13(2)(c) has been deleted. Now companies can allot securities on preferential basis without being fully paid up.

- The existing Rule 13(2)(h) has been substituted which will now require companies to determine the price of resultant equity shares to be allotted at the time of conversion of convertible securities issued on preferential basis on the following terms:

- Either upfront at the time when the offer of convertible securities is made, on the basis of valuation report of the registered valuer given at the stage of such offer, or

- At the time, which shall not be earlier than thirty days to the date when the holder of convertible security becomes entitled to apply for shares, on the basis of valuation report of the registered valuer given not earlier than sixty days of the date when the holder of convertible security becomes entitled to apply for shares.

- The company shall take a decision on sub-clauses (i) or (ii) at the time of offer of convertible security itself and make such disclosure under Rule 13(2)(d)(v).

Alteration of Share Capital:

Now companies having no share capital will be required to file form SH-7 with the Registrar of Companies within 30 days if there is increase in number of members.

Debentures:

- Rule 18(1)(b) has been substituted which will now enable companies to create charge on the properties or assets of the holding, subsidiary or its associate companies. This is a much required relief for companies as this will aide companies to create charge on assets within its group. This will give additional room to leverage within its group companies.

- Rule 18(1)(d)(i) has been substituted which will enable companies to create charge on the movable properties of its holding, subsidiary or associate company.

- Rule 18(7)(b)(ii) has been substituted, werein the provision (i) and (ii) has been made very specific with regard to creation of debenture redemption reserve on the value of outstanding debentures only.

- After Rule 18(7)(b)(iii) a new provision has been added which now require Companies to create Debenture Redemption Reserve for Debentures Redeemed prematurely equivalent to the amount of Debenture value that have been redeemed prematurely. By virtue of creation of Debenture Redemption Reserve for the premature redemption, even if the overall reserves exceeds the Statutory limit of 25%, still the companies are required to create Debenture Redemption Reserve equivalent to the Debenture Amount that are redeemed prematurely.

Conclusion:

The New Rules are monumental in easing the norms for budding Start Ups. The New Rules will help companies to consolidate the creation of charge on assets both immovable and movable of various companies within its group. The amendment is inclined towards government’s objective of ease of doing business in India. The rules are of paramount importance for the growth of Start Up culture in India.

Notes:

- Notification number GSR 180(E) dated 17th February, 2016 ↩

Foreign Investment in Rupee denominated bonds issued overseas by Indian Corporates

Private Placement and Preferential Allotment

Leave a comment

You must be logged in to post a comment.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.