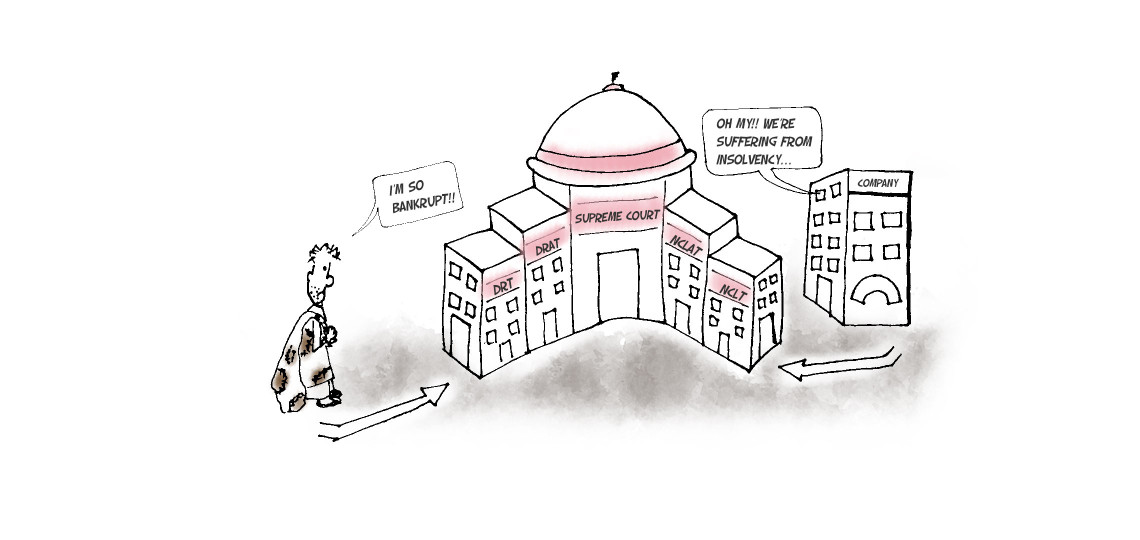

Insolvency and Bankruptcy Code, 2016

In order to bring a straight jacket law and to avoid multiple overlapping laws and adjudicating forums dealing with financial failure and insolvency of companies, firms and individuals in India, Insolvency and Bankruptcy Code 2016 (‘Code’) has been passed.

It is an Act to consolidate and amend the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms and individuals in a time bound manner for maximization of value of assets of such persons, to promote entrepreneurship, availability of credit and balance the interests of all the stakeholders including alteration in the order of priority of payment of Government dues and to establish an Insolvency and Bankruptcy Board of India.

This Act extends to whole of India. However, insolvency resolution and bankruptcy for individuals and partnership firms shall not be applicable to the State of Jammu and Kashmir. The code does not address financial firms. The Act is yet to be notified.

Application of the provisions of the code

The provisions of this Code shall apply to:

- Any company incorporated under the Companies Act,2013 or under any previous Company law.

- Any other company governed by any special Act.

- Any Limited Liability Partnership incorporated under the Limited Liability Partnership Act,2008.

- Such other body incorporated under any law for the time being in force.

- Partnership firms and individuals.

Insolvency and Bankruptcy Code 2016

The idea of the new law is that when a company defaults on its debt, control shifts from the shareholders/promoters to a committee of creditors, who have 180 days to evaluate proposals from various players about resuscitating the company or taking it into liquidation.

Insolvency resolution and liquidation for corporate persons

- Insolvency and liquidation of corporate debtors is applicable where the minimum amount of default is Rs. 1 lakh and this limit may be increased up to Rs. 1 crore by the Central Government.

- A financial creditor, an operational creditor or the corporate debtor itself may initiate insolvency resolution process at the NCLT. the process can be initiated when there is a default.

- The insolvency resolution process shall be completed within a period of 180 days. This can be extended for 90 days by the Adjudicating Authority where 75% of the financial creditors agree.

- NCLT shall, within 14 days of the receipt of the application for insolvency resolution either admit or reject the application.

- However, there is a moratorium on the debtor’s operations ordered by the NCLT for the insolvency resolution process. This operates as a calm period during which no judicial proceedings for recovery, enforcement of security interest, sale or transfer of assets, or termination of essential contracts can take place against the debtor.

- A resolution professional inclusive of interim resolution professional is appointed to conduct the insolvency resolution process. The resolution professional is appointed by the NCLT and the Resolution Professional’s basic function is to take over the management of the corporate borrower and operate its business as a going concern under the board directions of a committee of creditors 1.

- The committee of creditors will have the power to decide the final solution by majority vote in the negotiations and also to consider the proposals for the revival of the debtor and must decide whether to proceed with a revival plan or liquidation within a period of 180 days.

- An insolvency resolution plan prepared by the resolution professional has to be approved by a majority of 75% of voting share of the financial creditors. If the resolution plan does not receive the requisite votes, the Adjudicating Authority will make an order for the liquidation.

Insolvency Resolution Process for Individuals/ Partnership firms

- Insolvency resolution and bankruptcy for individuals and partnership firms is applicable where the minimum amount of default is Rs. 1000/- and this limit may be increased up to Rs. 1 Lakh by the Central Government.

- Under the automatic fresh start process, eligible debtors (basis gross income) can apply to the Debt Recovery Tribunal (DRT) for discharge from certain debts not exceeding a specified threshold, allowing them to start afresh.

- In the Insolvency Resolution Process, the creditors and the debtor will engage in negotiations to arrive at an agreeable repayment plan for composition of the debts and affairs of the debtor, supervised by a resolution professional 2.

Insolvency and bankruptcy Institutions

Adjudicatory Authorities

1. For corporate insolvency and liquidation-

2. For Individuals and other persons-

Conclusion

The Code extends to speed up the process of revival/re-organisation and early identification of financially distressed companies, limited liability entities,individuals and partnerships. Also, this Code attempts to streamline and consolidate all the provisions of different laws and make it more simple. The institutional framework created by the Code helps in time bound insolvency resolution process and liquidation. When decisions are take in a time-bound manner, there is a greater chance that the company can be saved as a going concern and the productive resources of the economy be put to best use.

Investor Protection Fund of Depositories

NCLT Vs. CLB

Leave a comment

You must be logged in to post a comment.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.