GST = Good Simplified Tax

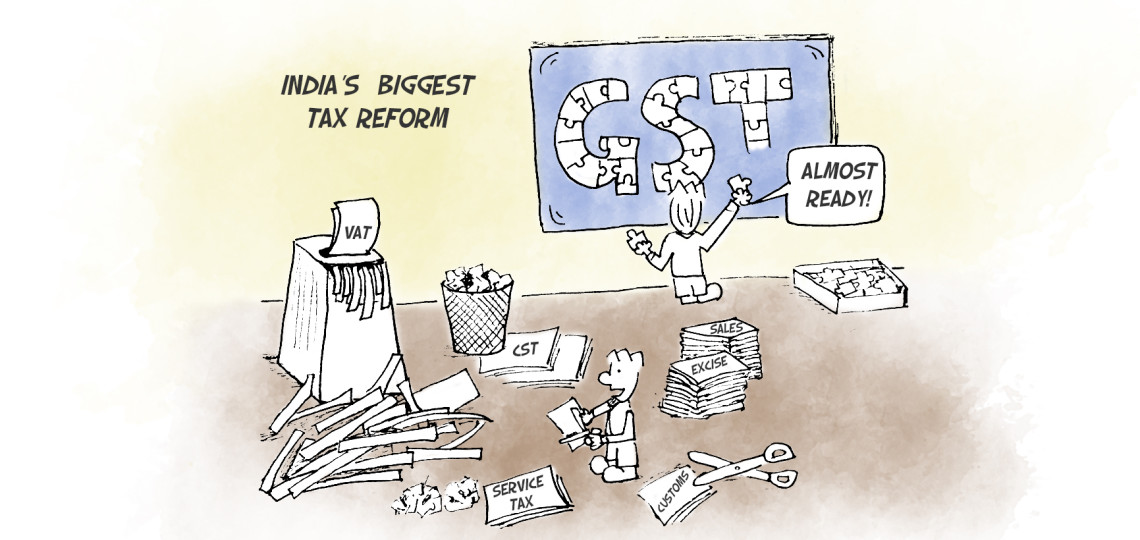

Goods and Services Tax (GST) is indirect tax. Perceived as one of the most important tax reform in independent India, it was introduced in the 122nd Constitution Amendment Bill. It is a game changer as it is considered having far reaching consequences on the GDP and economy of the country.

GST decoded

The GST is a uniform tax that is proposed to be levied on all goods and services produced in the country and on all goods and services imported from abroad. It is a comprehensive indirect tax on manufacture, sale and consumption of goods and services throughout India (except state of Jammu and Kashmir).

The objective is to consider India as one market. It will eventually replace a number of laws – VAT, Service Tax, CST, Excise, Customs, CENVAT, Entertainment tax, Luxury tax and related taxes.

How the GST works

Let’s say there is a manufacturing unit. In the present scenario, such unit will file income tax return and pay excise duty to the central government. When the manufactured product is supplied to dealers or retailers, the manufacturing unit will have to incur and pay value added tax –VAT. If there is an interstate sale involved, then it will additionally pay Central Sales Tax.

Let’s say there is a manufacturing unit. In the present scenario, such unit will file income tax return and pay excise duty to the central government. When the manufactured product is supplied to dealers or retailers, the manufacturing unit will have to incur and pay value added tax –VAT. If there is an interstate sale involved, then it will additionally pay Central Sales Tax.

Similarly if services are rendered, service tax will have to be paid. Therefore, it is evident that the goods or services are taxed at multiple levels and multiple times. As a result, transaction cost and compliance cost increases.

Now, the GST will be tax on goods and services that are manufactured, produced and consumed. Such tax will be levied at each point of sale of goods or rendering of services. At the time of such sale of goods or rendering of services, the seller or service provider, may claim the input credit of tax which he has paid while purchasing the goods or procuring the services.

The GST seeks to lower and minimise (if not entirely remove) the number of such transactions and compliances. As a result the transaction cost and compliance cost will be significantly lesser. This is widely believed to help all business and business entities alike.

Destination based tax

The GST is destination based tax where the tax is not applied at the point of production but at the point of supply or consumption.

GST @ destination:

- Imports – taxed in India

- Exports – No tax in India

- Interstate transactions – Tax in state of final destination (not origin)

The intention of implementing the GST regime by the government is to impose uniform pricing across all States.

Levy of GST

- The levy of GST will be concurrent – levied by both the Central government and State government

- The GST rates vary from a minimum of 5% to 28%.

- Lower rates of tax are for essential commodities and the highest rates of tax are for luxury commodities.

- CGST can be cross credited with CGST only. Likewise for SGST. CGST and SGST cannot be cross credited with one another.

- CGST and SGST can be cross credited with IGST.

- 5 Union territories (except Delhi & Puducherry) will adopt UTGST Act.

Challenges in implementing GST

- Being an integrated or uniform which has impact on all States and union territories, it is necessary to lay down clear and exhaustive definitions of what constitutes goods, services, manufacture, sale and the like. This will minimise ambiguity in interpretation of law.

- Deciding the threshold limit of applicability is a key factor as it involves a balancing act between ensuring maximum business entities being brought under GST ambit without burdening the smaller business entities.

- Since the GST is being construed as a one stop shop tax levy which can be paid online, a state of the art latest and well-designed IT infrastructure becomes the fulcrum of GST implementation to ensure smooth compliance.

- Effective dispute resolution mechanism between States is absolutely necessary.

Conclusion

The Government of India has announced its plan to make the GST law operational with effect from 1 July 2017. The process of migration of existing business to the GST is going on in full swing.

Many developed and developing nations the world over have already implemented the GST successfully.

The GST, when implemented effectively will facilitate seamless movement across the nation and will reduce the overall transactional and compliance cost of running the business. This will in turn ensure increase in GDP and economic growth.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.