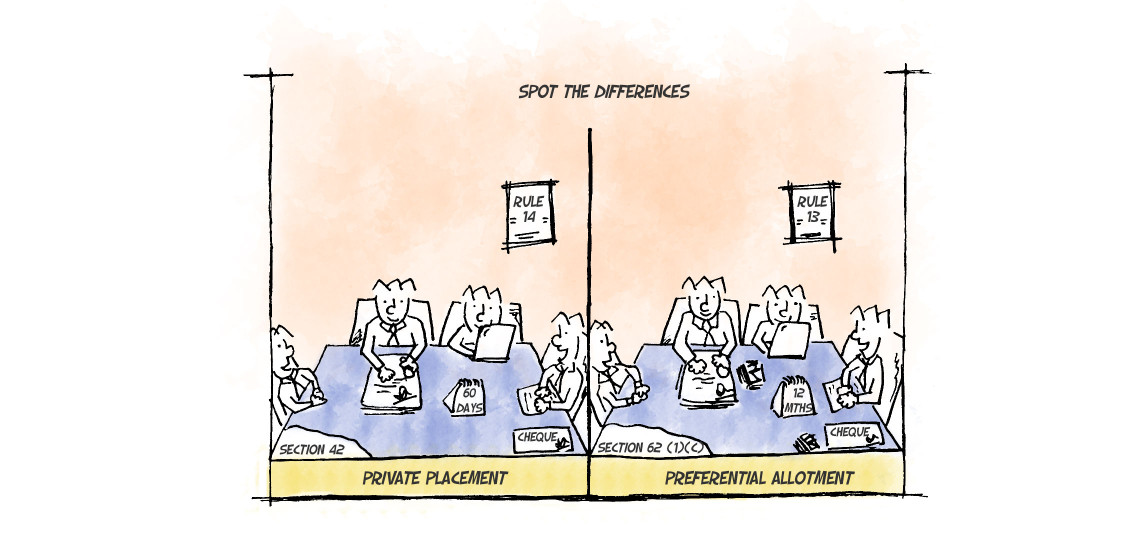

Private Placement and Preferential Allotment

Private placement refers to ‘offer of securities or any invitation to subscribe to securities’ by any company to a selected group of investors. Preferential allotment, on the other hand. refers to issue of shares or other securities by a company to any select person or group of persons on a preferential basis and does not include shares or other securities offered through a public issue, rights issue, employee stock option scheme, employees stock purchase scheme or an issue of sweat equity shares or bonus shares or depository receipts issued in a country outside India or foreign securities. While Section 42 of the Companies Act, 2013 and Rule 14 of The Companies (Prospectus and Allotment of Securities) Rules, 2014 deals with private placement Section 62 (1) (c) of the Companies Act, 2013 and Rule 13 of The Companies (Share Capital and Debentures) Rules, 2014 deals with preferential allotment of shares.

Applicability of Section 42

Any company which wants to raise funds other than by way of public offer, whether public or private, listed or unlisted, has to comply with the requirements specified under the Section and relevant Rules.

Conditions for making private placement

- The issue has to be approved by the shareholders by way of special resolution.

- The company while making a private placement has to issue a ‘private placement offer letter’ instead of a prospectus.

- The offer letter should be accompanied by an application form serially numbered and addressed specifically to the person to whom the offer is made. No person other than the one for whom the offer letter is addressed shall apply for the shares of the company.

- The company is prohibited from issuing any kind of public advertisement or inform the public at large regarding the offer.

- The issue cannot be made to not more than 200 persons in aggregate in a financial year excluding qualified institutional buyers and issue of securities to employees under stock option.

- The face value of securities offered per person shall not be less than Rs. 20,000/-.

- All monies payable towards subscription has to be made by way of cheque, demand draft or any other banking channels and not by way of cash.

- Allotment has to be made with in sixty days from the date of receipt of the application money failing which the company is liable to pay interest at the rate of 12% per annum from the expiry of sixtieth day.

- The company has to maintain a complete record of those to whom the offers and invitations have been made by way of private placement and has to file with the ROC a return of Allotment made. In case of listed company, the return has to be filed to SEBI in addition to ROC.

Comparison vis-à-vis the Companies Act, 1956 and Companies Act, 2013

Section 67 of the 1956 Act provides for issue of securities to a selected group of persons. According to the section, an offer shall be treated as “domestic concern” and not as a public issue if it is calculated to result in subscription or purchase of shares only by persons to whom the offer is made, provided if the offer is made to less than 50 persons. The ceiling of 50 persons is however not applicable to public financial institutions or a non-banking financial institution. The section is stringent that if the offer is made to 50 persons or more, it will be deemed to be a public issue. However, Section 42 of Companies Act, 2013 is flexible and it provides for enhancement of the limit by the Central Government by way of notification of Rules. Also, Section 42 is applicable to Private Companies bringing them under surveillance.

Applicability of Section 62 (1) (c)

The section does not differentiate between a public company or a private company and hence the provision is applicable to private companies also.

Conditions for making preferential allotment of shares

- Preferential issue of share should also comply with the conditions of Section 42 pertaining to private placement.

- Such issue should be authorized by the Articles of Association and approved by shareholders by way of passing a special resolution.

- Securities allotted should be fully paid up.

- Allotment should be completed within a period of 12 months from the date of passing of special resolution. If not, a fresh resolution has to be passed.

- The prices at which the securities are allotted shall be determined on the basis of valuation report of a registered valuer.

Additional requirements to be complied with in case of a listed company

In addition to the above conditions, a listed company should also comply with SEBI (Issue of Capital and Disclosure Requirements) Regulations 2009 pertaining to preferential issue such as:

- Compliance with the minimum pricing regulations

- Compliance with the conditions of continuous listing

- The issue shall not be made to made to such persons who sold their securities during the period stated in the regulations and to persons belonging to promotor group who had failed to subscribe to warrants issued by the company.

- Allotment shall be made within 15 days of passing of the special resolution. If not, a fresh resolution has to be passed.

- The securities allotted on a preferential basis shall be subjected to lock-in requirements.

Comparison vis-à-vis Companies Act, 1956 and Companies Act, 2013

The provisions relating to further issue of shares is contained Section 81 of the Companies Act, 1956. Section 81 is applicable only to further issue of shares made after two years of incorporation or one year after the first allotment was made, whichever is earlier whereas Section 62 of the Companies Act, 2013 is applicable at any time when a company wishes to increase its subscribed capital by the issue of further shares. Section 81 is not applicable to a private company whereas Section 62 does not differentiate between a private company and a public company.

Difference between private placement and preferential allotment

S No |

Particulars |

Private placement |

Preferential allotment |

| 1. | Issue | Issue of any kind of security as defined in Section 2(h) of Securities Contract (Regulation) Act, 1956. | Issue of shares or other securities namely equity shares, fully convertible debentures, partly convertible debentures or any other securities, which would be convertible into or exchanged with equity shares at a later date. |

| 2. | Offer document | It shall be in form PAS 4 | No such requirement |

| 3. | Consideration | Consideration shall be paid by way of cheque, demand draft or through any other banking channel but not by way of cash. | Shares can be issued for cash or for a consideration other than cash. |

| 4. | Bank Account | Separating Bank Account has to be maintained for keeping the application money. | No such requirement |

| 5. | Valuation Report | No valuation Report is required. | Valuation Report is required. |

| 6. | Authorization in Articles | No authorisation in AOA required. | Authorisation in AOA is required. |

| 7. | Allotment | Allotment has to be made within 6o days of the receipt of application money. | Allotment has to be made within 12 months from the date of passing of special resolution. However, in the case of listed company, allotment has to be made within 15 days of passing of the special resolution. |

| 8. | Documents involved | PAS 3 (return of allotment of securities), PAS 4 (private placement offer letter) and PAS 5 (a complete record of private placements to be maintained by the company) | The company shall file return of allotment in form PAS 3 with the Registrar of Companies. |

Though private placement and preferential allotment appears to be similar, there are differences between them. Section 42 is drafted carefully after a highly controversial litigation on the subject of private placement namely SEBI vs Sahara 1. Section 42 and 62 of the Companies Act, 2013 is applicable to private companies as well thereby bringing them under the close regulatory oversight and reducing the differences between private and public companies with regard to compliance. Private companies will now be required to file returns on who the offers were made and also maintain a record of private placements made. All these provisions ensure transparency and thereby achieving the ultimate objective of good corporate governance.

Notes:

- 2015 (112) ALR 21 ↩

Companies (Share Capital and Debentures) Third Amendment Rules, 2016

Class Action Suit: A Double Edged Sword for Corporate Devils!

Leave a comment

You must be logged in to post a comment.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.