CCI- How it Perceives Predatory Pricing

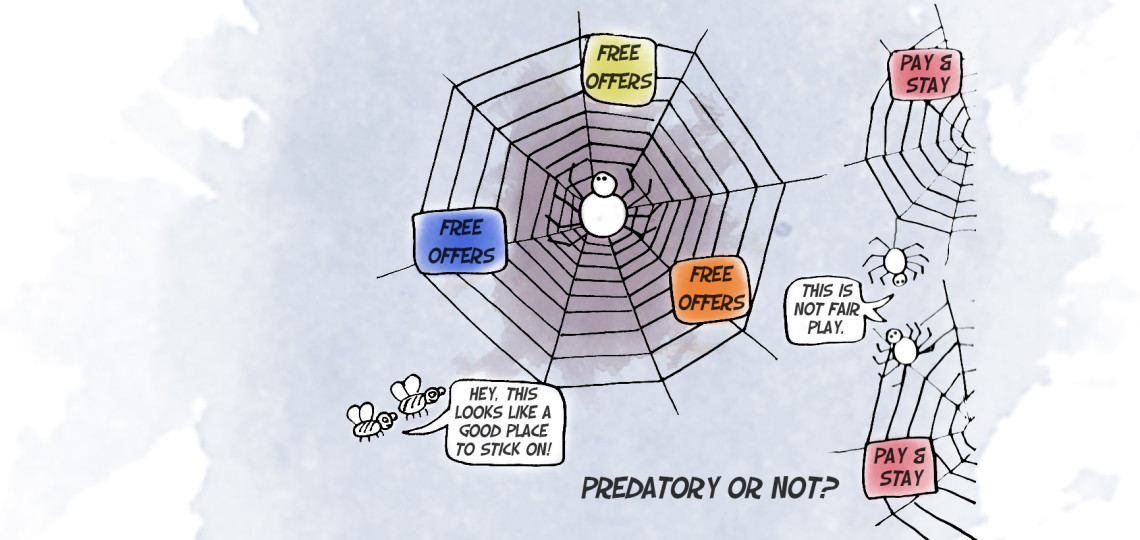

Recently, India’s largest telecom service provider Bharti Airtel Ltd filed a complaint against Reliance Jio Infocomm Ltd with Competition Commission of India (CCI), accusing the latter of intending to become a monopoly by ‘predatory free pricing strategy’.

The focus is on ‘predatory pricing’ as a tool of (ab)using the dominant position of an entity. The Competition Act, 2002 1 defines “predatory price” to mean the sale of goods or provision of services, at a price which is below the cost, as may be determined by regulations, of production of the goods or provision of services, with a view to reduce competition or eliminate the competitors.

Simply put, it is the pricing of goods or services at such a low level that other firms cannot compete and are forced to leave the market. In Re: Johnson And Johnson Ltd 2 it was said that “the essence of predatory pricing is pricing below one’s cost with a view to eliminating a rival.”

Dominance is a pre-condition to predatory pricing. Only if an entity is in a dominant position, will the question of its predatory pricing arise. M/s Mega Cabs Pvt. Ltd Vs M/s ANI Technologies Pvt. Ltd 3 If it not in a dominant position, its pricing technique will be irrelevant.

Predatory pricing has been declared as anti- competitive and illegal by many countries. In India, this issue has been covered in the Competition Act, 2002 (which replaced the Monopolies & Restrictive Trade Practices Act, 1969). The Indian competition law almost entirely relied on the laws passed by the European Commission of Justice (ECJ) and the US laws.

Judicial precedents

The ECJ through it most celebrated case AKZO Chemie BV v Commission 4 laid down the general principles on deciding on predatory pricing – (i) First, prices below average variable costs must always be considered abusive. There could be no other economic purpose other than to eliminate competition as each item produced and sold entails loss for the entity. (ii) Secondly, prices below average total costs but above average variable costs are only to be considered abusive if there exists an intention to eliminate competition. The ECJ took a similar view in the case Tetra Pak International SA v Commission of the European Communities 5. In the said case, the ECJ held that while it is not easy to objectively identify the intention, the same can be inferred through number of factors. Factors such as the duration, the continuity and the scale of the sales at a loss, the accounting data showing that the dominant company imported some products only to resell them below cost in the targeted area, deliberately incurring losses and related factors throw light on the intention.

The US court, in the case of Brooke Group Ltd v. Brown and Williamson Tobacco Corporation 6 observed that to establish predatory pricing, it should be necessary to look for an element of mala fide intention of eliminating competition. Whether the lowering of prices was resorted to in order to survive in the competitive market or was done to eliminate competition had to be ascertained. If it were a survival tactic, then it need not be struck down as illegal.

In the case of M/s Fast Track Call Cab Private Limited v. M/s ANI Technologies Pvt. Ltd. 7 the Competition commission of India was of the prima facie view that providing more incentives and discounts to customers and drivers compared to the revenue earned amounted to predatory pricing as it resulted in ousting the existing players out of the market and created entry barriers for the potential players against provisions of Section 4 of the Act.

Conclusion

The case against Reliance Jio has opened up a pandora’s box on the issue of predatory pricing. Laws across countries have not objectively dealt with predatory pricing. While the Competition Act, 2002 has defined “predatory pricing”, it has not been exhaustively defined. Similarly, neither the ECJ nor the US courts have laid down the minimum price below which the price would be considered predatory. They have only harped on the price being not below the average variable cost. This is probably because the average total cost tends to fluctuate. However, a detailed analysis of judgements handed out under laws of various countries helps us infer that primarily, an entity must be in a dominant position for it to resort to predatory pricing. Even if it satisfies the criterion of dominance, secondly the pricing it resorts to shall be concluded as illegal /anti-competitive based on its intention to wipe out competition in the relevant market. The Courts have to ensure that the dominant players do not restrict entry of newer and smaller business entities by attracting consumers through low pricing, while their intention was solely to drive out competition. This requires all laws to be more exhaustive than it is at present.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions. Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade. During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc., Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation. A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu. M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu. Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years. An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group. Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking. Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore. K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience. Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017. S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.