Insights

No Limited Liability = R.I.P Entrepreneurship

Insights

No Limited Liability = R.I.P Entrepreneurship

Insights – No Limited Liability = R.I.P Entrepreneurship

The latest

In July, 2017 a bankruptcy court ruled that a promoter cannot escape liquidation of her personal assets by simply filing for bankruptcy. This ruling has opened up a Pandora’s Box for the professionals and entrepreneurs alike.

Facts of the case

In the said case, Schweitzer Systemtek India Private Limited voluntarily filed the bankruptcy petition after it defaulted on a loan of Rs. 4.5 crores given by Dhanlaxmi Bank.

The loan had been taken by Schweitzer Systemtek India Private Limited from Dhanlaxmi Bank and the Promoter had pledged her personal properties. The Bank had then assigned the loan and the security to Asset Reconstruction Company – Phoenix ARC. The petition in NCLT Mumbai was filed by Phoenix ARC as a creditor against Schweitzer Systemtek India (Corporate Debtor).

Contention of Parties

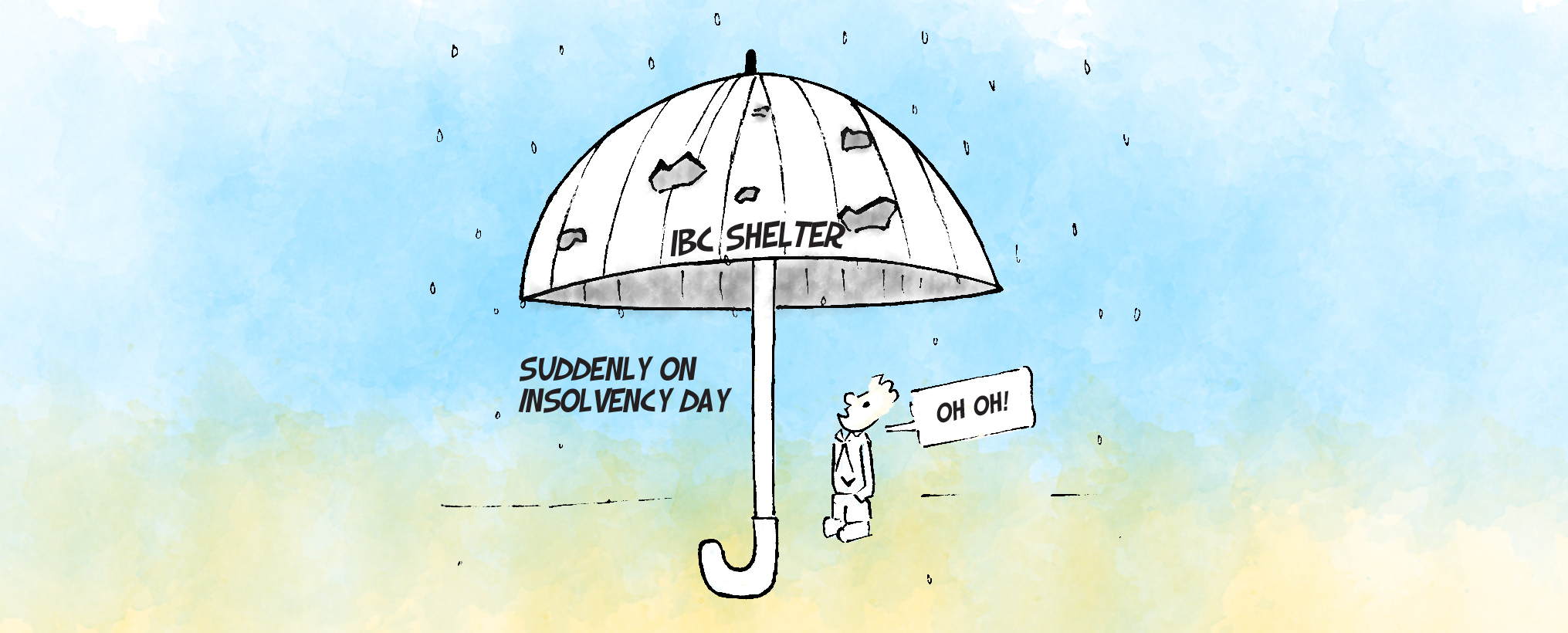

Schweitzer India (Corporate debtor) contended that once the application was “admitted” u/s 10 of the IBC, 2016, then, the moratorium period commenced wherein no action could be taken against the corporate debtor. Till the insolvency resolution process is completed, no assets or properties could be taken possession of or sold by the creditor(s).

On the other hand, the Phoenix ARC (Creditor) contended that Schweitzer India’s action to prohibit the creditor from taking over possession of assets was with malafide intention suggesting possible misuse of the moratorium period provided under the insolvency resolution process.

MORATORIUM UNDER IBC, 2016

A 180 – 270 day period from the date of insolvency commencement. During this, there is a prohibition on instituting any legal suit or proceeding or sale or disposal of assets or lien on the assets of the corporate debtor.

Insights – No Limited Liability = R.I.P Entrepreneurship

Order of the Tribunal

The NCLT, Mumbai while finding the case as being fit for being “admitted” u/s 10 of the Insolvency & Bankruptcy Code, 2016 also noted that the moratorium period under the insolvency resolution process was intended to be used as an effective tool in insolvency resolution. The tribunal further noted that there have been instances of it being misused by the corporate debtor to thwart the recovery proceedings.

But the most important question that was decided in this case – Whether properties /assets not owned by the Corporate Debtor (but are personal properties of the Promoters) shall come within the ambit of the moratorium period where they cannot be sold or disposed of to recover dues?

The Tribunal decided on the basis of plain reading of Section 14 of the IBC, 2016 that moratorium shall be declared to prohibit any action to recover or enforce any security by the corporate debtor in respect of ‘its’ property.

Simply put, the “no action on assets or properties” during the moratorium will apply only for asset/properties owned in the name of the corporate debtor companies. Personal properties of the promoters will not fall under the ambit of moratorium.

The NCLT order in Schweitzer India case has expressly made it possible for creditors (instead of waiting for the six-month waiting period) to go ahead and sell the promoter’s personal property, which was pledged with the banks.

Insights – No Limited Liability = R.I.P Entrepreneurship

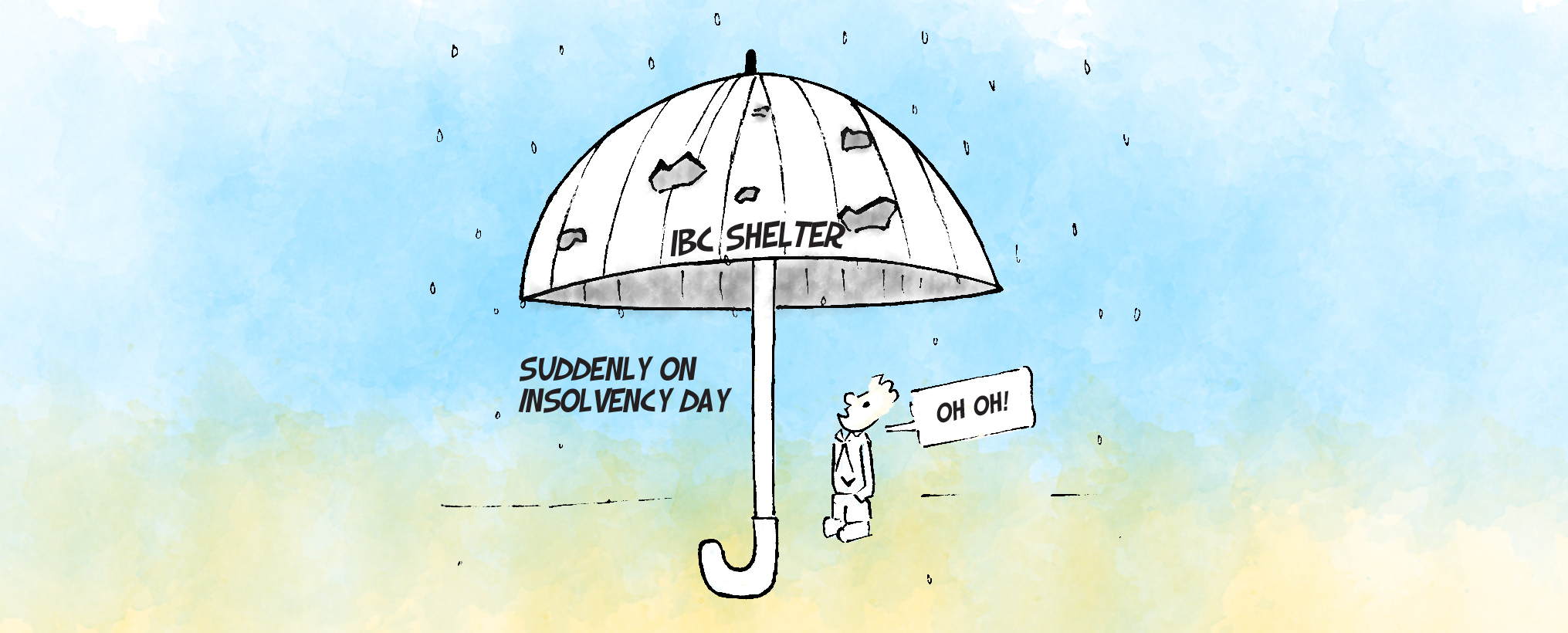

Merit of the case VS Spirit of the Law?

This case is touted to have far reaching impact on not only other similar cases pending in various benches of NCLT, but also impacts the psyche of the entrepreneur who seeks to start a company and scale up operations.

Though legal professionals are of the view that the order of the NCLT is entirely based on the merits of the case and strict interpretation of the insolvency resolution provisions, the larger issue of the spirit of the insolvency resolution process being followed, especially when voluntary IRP petition is filed seems to have been overlooked.

Many promoters, who are facing proceedings in the NCLT Bench, are staring at property /asset losses even before the stipulated period expiry of the moratorium period. Attaching the personal assets of a promoter is a violation of the basic principle of limited liability based on which entities like limited liability companies and Partnership firms. Only entities such as “One person companies” have the concept of limited liability wherein only the equity of the promoter is at risk. This stifles entrepreneurial and risks taking ability of individuals.

Insights – No Limited Liability = R.I.P Entrepreneurship

The way ahead

Limited liability is a double edged sword – while the liability is limited only to the extent of shares or stakes held by the promoters in the startup companies, there have been cases where it has been misused to the advantage of the promoters. As it is, the concept of limited liability has several exceptions as contained in the statute itself be it the Companies Act and the Income Tax Act; and also by the judicial pronouncements.

Creators of Legal statutes and precedents have the onerous task of ensuring the legislations are created with a fine balance in such a way that the concept of limited liability is optimally used.

Banks insist on creating personal guarantees thereby holding leash on the Promoters to ensure they take responsibility of the repayment. Further, they have been directed to devise appropriate loan recovery mechanism based on the reasonable satisfaction of lenders claims. Till such time, the Promoters will have to take the brunt of the loan recovery process, especially where their personal assets are pledged.

Source:

Schweitzer Systemtek India Private Limited Vs Phoenix ARC, NCLT Mumbai

TCP/1059/397-398/CLB/MB/MAH/2016

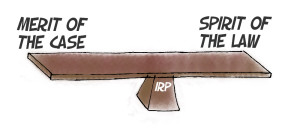

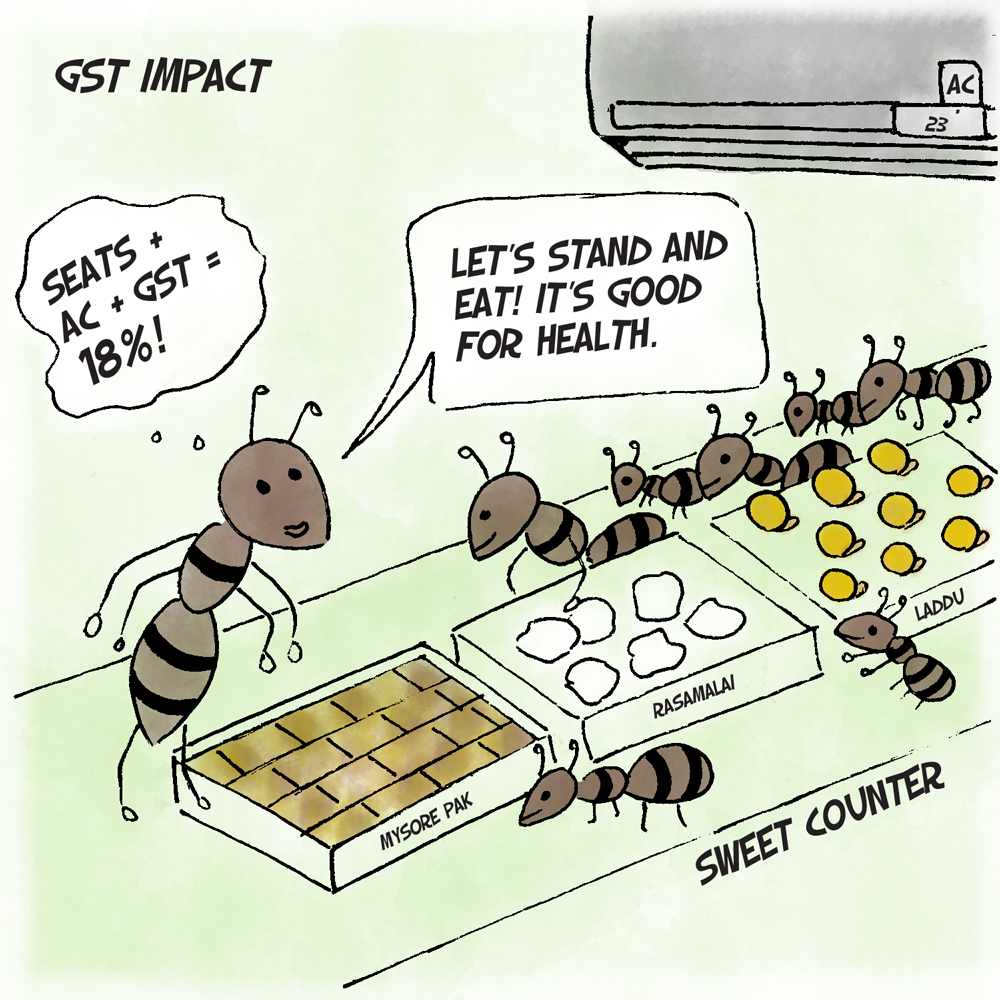

Infographic

Circulars & Notifications

MCA

Notification dt 13.07.2017 MCA issues corrigendum to notification no. G.S.R. 583(E)

SEBI

Cir. dt. 11.07.2017 Amendments to Investor Grievance Redressal System & Arbitration Mechanism

Cir. dt 11.07.2017 Amendments on Guidelines for participation/functioning of Eligible Foreign Investors

Cir. dt 18.07.2017 Disclosure of divergence in the asset classification & provisioning by banks

Cir. dt 20.7.2017 Investments by FPIs in Corporate Debt

Cir. dt 24.07.2017 Online Filing System for Real Estate Investment Trusts & Infrastructure Investment Trusts

Cir. dt. 25.07.2017 Position Limits for Agricultural Commodity Derivatives

Cir.dt.27.07.2017 Securities and Exchange Board of India (International Financial Services Centers) Guidelines, 2015–Amendments

Cir.dt. 31.07.2017 Online Filing System for Alternative Investment Funds

Lawlipop

No law can give me the right to do what is wrong

Abraham Lincoln

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He has over 18 years of experience in both litigation and advisory practice. He specializes in all aspects of Corporate Law with a complete focus on Mergers and Acquisitions, Insolvency and Bankruptcy, Contracts etc.,

He conceptualized and created www.IBCcases.com, India’s first unique, exclusive and now the most exhaustive Research Engine on the ‘Law of Insolvency and Bankruptcy’. IBCcases.com was launched by Dr M.S. Sahoo, Chairperson of the ‘Insolvency and Bankruptcy Board of India’.

He has co-authored a unique book published by Lexis Nexis titled ‘Supreme Court on Insolvency and Bankruptcy Code’, which is a consolidation of a section-wise analysis of all decisions of the Supreme Court.

Mr Suman is a member of the Governing Council of the Indo-Japan Chamber of Commerce, focusing exclusively on trade between India and Japan. He was instrumental in completing an economic survey on ‘Indian Industry expectations from Japanese Companies in Tamil Nadu’.

Mr Suman and his Firm are actively engaged in the international arena to attract foreign investments into India. Mr Suman has organized several India-focused Webinars with the United Nations Industrial Development Organization, ITPO Tokyo. He also organized and completed a unique ‘Issue resolution summit’ for foreign companies and successfully resolved issues on fast-track mode with the support of the Central Government and the State Government of Tamil Nadu.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

His expertise also extends to Trade Related Intellectual Property Rights (TRIPS), Joint ventures/Collaborations especially in Related company valuation and related party transactions, Indirect Tax Advisory, Tax Compliance, Foreign Trade Advisory and IP Management.

He has a super specialization in sectors such as Health, Construction, Automotive, Pharmaceuticals, Agriculture, STEM, Information Technology, Transport and e-Commerce.

He served in various capacities as AO/AC/DC/JC with distinction in Tamil Nadu and Andhra Pradesh reaching the position of ‘Commissioner-Central Excise, Customs and GST’ during which he adjudicated a large number of cases related to the above areas.

During his stint in Tamil Nadu, he held senior positions including Head of Office, and Head Central intelligence unit and vigilance wing, Director of National Academy of Customs, Excise & Narcotics and Systems Manager of the Commissionerate during the implementation of Automation of Central Excise and Service Tax (ACES) and ICES 1.5.

While in Andhra Pradesh, he took on the challenging task of leading the GST implementation team, supervising, and controlling the administration of Tirupati, Vizag and Kakinada GST formations.

As the Zonal Unit Approval Committee Member, he approved number of SEZs and 100% EOU Units in MEPZ, STPI, Mahindra City SEZ, SRI City and Vizag SEZ’s.

He graduated with a degree in Agriculture and then went on to get his Law Degree and has a Masters in Management Systems from BITS, Pilani. Mr. Muthusamy is academically trained in the e-governance of revenue collection conducted by BITS Pilani, Special intelligence course for Revenue Officers (SICO) conducted by the Cabinet Secretariat, Gurgaon. Mid-Career Training Program of IRS (C&CE) Officers, Phase 4 by NACEN, Faridabad, IIM, Lucknow, London School of Economics, Cambridge University, UK and Nyenrode Business School, Amsterdam and Rules of Origin, Green Customs, IPR Implementation by WCO.

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

Some of the important cases dealt with by him are the Jet Airways case, Veer Gurjar Aluminum Industries, Innoventive Industries, Kirusa Software and the Tata Sons v. Cyrus Investments case.

Before joining the NCLT, he held important positions in the Madras High Court for 23 years in various capacities such as the Assistant Registrar (Insolvents Accounts) – Original Side admitting plaints, the Deputy Registrar – Judicial side supervising all Judicial Sections of the Registry, the Deputy Registrar (Administration), Co-ordinator of the High Court’s Mediation Centre, Joint Registrar. Finally, he acted as the Official Assignee of the High Court of Madras, administering Insolvency Estates for over four years.

Mr Nallasenapathy is presently a practising lawyer and a Partner at A.K. Mylsamy and Associates LLP. He advises clients on various corporate matters and represents clients before NCLT’s, NCLAT’s, High Courts and the Supreme Court.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

She holds a post graduate degree in Business Laws from National Law School of India University (NLSIU) (MBL) and a bachelor’s degree from Symbiosis Law College, Pune (LLB). In addition, she holds a second bachelor’s degree in Commerce (B.Com).

She is professionally trained in mediation by Singapore Mediation Centre (under the aegis of the Singapore Supreme Court) and is an MCPC certified mediator (Mediation and Conciliation Project Committee under the auspice of the Hon’ble Supreme Court of India). She is associated with Tamil Nadu Mediation and Conciliation Centre (TNMCC), annexed to the Hon’ble High Court of Madras.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

With over 53 years of standing at the Bar, he is known for his professional integrity and expertise in corporate and civil law.

He heads the litigation and arbitration practice of the Firm and regularly appears before various High Courts, the National Company Law Tribunals, the National Company Law Appellate Tribunal and the Supreme Court. He specializes in civil and commercial litigation with specific focus on shareholders litigation and the Insolvency and Bankruptcy practice of the Firm.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

She also holds a Degree in fine arts and is the creative brain of the Firm. She manages the Firm and handles the ‘The Law Tree’ which is the Firm’s legal monthly newsletter.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

He served in various capacities and in various parts of the Nation including Tamil Nadu, Karnataka and Andhra Pradesh. As Assistant Director in the National Academy of Customs, Excise and Narcotics (NACEN), Bangalore, he enthusiastically conducted classes on Customs, central Excise, Service Tax and Narcotics control to the Departmental Officers of various grades belonging to the entire State of Karnataka. At the time of launch of Goods and Service Tax, he had undertaken the task of training the Departmental Officers of both the State and Central Governments on the complex legal provisions of GST. The Officers of both the Governments fondly recognize him as the Guru and constantly in touch with him for seeking clarifications on tax matters. With his rich experience and expertise, he had taken enormous interest for the implementation of Automation of Central Excise and Service Tax (ACES).

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

During his stint at ITC hotels, he also headed the Human Resource & Training function as Vice President – Human Resources. Ashok Anantram represented the company at several interactions with Government and Industry Associations on Tourism and Hospitality. He also held key positions in tourismindustry bodies.

He has a passion for teaching and has been faculty at numerous programs related to marketing and hospitality, including the Department of Marketing, University of Strathclyde, UK where he taught Sales & Marketing in their MBA program.

Following his retirement in 2003, he moved to Chennai and was President – Business Development at Apollo Hospitals Ltd. Currently he is a Consultant in good marketing and strategy to several Organisations.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Later on, he became the Group CEO of the M.R. Kodandaram Group [a part of the M.S. Ramiah Group, Bangalore] in respect of a 5 Star Hotel and their Chemical and Bio Technology ventures. As the CEO, he successfully completed the construction of the hotel and also managed its operations.

He has contributed to several columns of the New Indian Express newspaper on issues relating to Personal Finance.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Served at different Custom Houses namely New Custom House Mumbai, Air Cargo Complex Import Commissionerate, JNCH Nhava Sheva. As Assistant Commissioner, posted to Jamnagar Customs and during 2006 to 2010 served as Deputy Commissioner at Nhava Sheva.

Served as Joint Commissioner in Pune Customs and as an Additional Commissioner in Pune Central Excise. In 2018, went for Mid Career Training Programme (MCTP) to United Kingdom, Belgium and Netherland.

Served as Additional Commissioner at GST, Navi Mumbai & at Mumbai Customs JNCH and in ACC in Export Commissionerate.

Mr.R.Sekar, Indian Revenue Service (R) of 1984 batch was formerly Joint Secretary (Tax Research Unit), Department of Revenue, Ministry of Finance, Government of India and retired as Principal Commissioner in the year 2016.

Mr.Sekar served in the policy making body of the Central Board of Indirect Tax (Tax Research Unit) during the period 1991 to 2008 at various capacities and associated with making of 15 Union Budgets.

His assignments include

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

He is a Specialist Editor of the Ramaiya’s Guide to the Companies Act, 17th Edition. He has authored a popular commentary on Mergers and Acquisition known as ‘Mergers et al’ [released in 2011 with the third edition being the latest] and the book ‘Brands Costs, Concepts and Case Studies’.

He is a faculty member of the Institute of Chartered Accountants of India, Institute of Costs and Works Accountants of India, Institute of Company Secretaries of India, Institute of Chartered Financial Analysts, visiting faculty at the Indian Institute of Management, Bangalore, National Law Schools, etc.,

He devotes substantial time in the academic field, associating with faculty members and enriching the career orientation of students. He has delivered many lectures and presented papers in conferences and is a regular contributor to the Hindu and the Business Line.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

He has obtained training in India and Abroad on matters relating to Banking, Housing, Micro-Finance and Tax planning. He held senior positions in the National Housing Bank and Syndicate Bank between 1978 and 1996 and was a Legal Advisor for various Banks while practicing law.

He is the Former Vice-Chairman [judge] of the Company Law Board which position he occupied for over 12 years and has over 500 reported cases to his credit. He resumed his legal practice in 2009.He acts as an Arbitrator, Conciliator and Mediator.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Besides a stellar legal career spanning nearing four decades, Justice Jaichandren was and is actively associated with several educational, social, cultural and service associations / organizations. The academic in him shines bright. While he is a teacher at prestigious legal institutions, he is also a student pursuing post-doctoral research in Law, University of Madras. Not only has he participated in several legal conferences and seminars, he has judged several moot court competitions and put together team(s) that would represent Indian legal talent internationally. His passion for human rights and environment protection saw him filing public interest litigations of importance.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

He initially joined the Indian Postal Service in 1966 through the Civil Service Examination. Thereafter, he became a member [judge] of the Company Law Board on its initial constitution in the year 1991 a position he occupied for a period of 19 years.

He was also the Chairman of the Company Law Board for over 12 years and has dealt with over 3000 cases and has over 600 reported cases to his credit. One of the landmark cases dealt by him was Satyam Computers Ltd, which due to his pro-active and timely decisions/orders was revived within a short period of 6 months.

He is a General Editor of the ‘Ramaiya’s Guide to the Companies Act, 2013’ and was the Chairman of the Editorial Board of the magazine ‘Chartered Secretary’ for 10 years.

He is also an Arbitrator and handles Arbitrations. He has 50 years of immense experience and expertise in Corporate Law.

I ACKNOWLEDGE HAVING READ THE DISCLAIMERS IN DETAIL AND AGREE TO THE SAME

DISCLAIMERS & USER ACKNOWLEDGEMENT

By subscribing to the Newletter, I explicitly acknowledge each of the following:

(a) I voluntarily wish to subscribe to the Newsletter after having read and acknowledging all Disclaimers on the newsletter and on the website,

(b) I desire to have updates and knowledge from A.K. Mylsamy & Associates LLP [‘AKM’] for my own information and use,

(c) there has been no solicitation, invitation or inducement of any sort whatsoever from A.K.M or any of its members to create an Attorney-Client relationship through the Newsletter or the website.

(d)The Newsletter is for AKM’s private circulation only and forward transmission or further dissemination of the same for any reason whatsoever is not permitted.

A.K. Mylsamy & Associates LLP [‘AKM’] provides this Website [www.akmllp.com] and/or the Newsletter [The Law Tree’] as a resource purely for informational purposes only and these shall not be construed under any circumstances as, (a) soliciting or advertisement of any nature whatsoever; (b) as legal/professional advice, circular or other basis for advertisement, personal communication, an invitation to tout etc.,. (c) constitution or creation of a Attorney-Client relationship by reason of the transmission, receipt or use or otherwise of the contents thereof.

The Website, Newsletter etc., is intended, but not guaranteed or warranted to be complete, correct and up-to-date. AKM assumes no liability for the interpretation and/or use of the information contained on this website, nor does it offer a warranty of any kind, either expressed or implied. AKM hereby disclaims any and all liability to any person/entity for any loss or damage caused by errors or omissions, whether such errors or omissions result from negligence, accident or any other cause such as but not limited to any inaccuracy, defect etc., which may have inadvertently crept in due to third party information or otherwise. You confirm that you will not act, or refrain from acting, based solely upon any or all of the contents of this Website or Newsletter.

This website does not intend links from this site to other websites to be referrals to, endorsements of, or affiliations etc., and AKM is not responsible for, and makes no representations or warranties about, the contents of such linked websites.