Insights

SFIO: Will hold you by your (White) Collar!

Insights

SFIO: Will hold you by your (White) Collar!

Insights – SFIO: Will hold you by your (White) Collar!

Background

The opening up of the economy internationally has indeed made the world a small place to live in. We have witnessed remarkable rise of many corporates world over in a short span of time. However, not all such success stories are legitimate. Over the last few decades there has been unprecedented increase in corporate or white collared crimes. These seem to be the unwanted by-product of economic growth and prosperity.

How can crime be “white” collared?!

It was probably not the intention to classify crime like the caste system, race or religion. Generally crimes or frauds committed by person of respectability and high social status in the course of their occupation has come to be termed as “white collared” crimes – as there is no violence or physical force involved. However, there is loss of trust.

This has become a worldwide phenomenon. Globally, the Enron scandal rocked the world in 2001. This was followed by the scam of the Lehman brothers in 2008.

Back home, the Harshad Mehta scam in 1991-92 shook India out of its slumber as it resulted in investor loss of approximately Rs. 5,000 crores. This led to the complete collapse of stock markets and eventual arrest and ban of Mr. Mehta from stock broking.

More recently, India has witnessed a spate of unsavoury scams and corporate scandals with quite a few of them having political connections / ramifications.

(In) famous corporate scams in India

Insights – SFIO: Will hold you by your (White) Collar!

The birth of the SFIO

In the light of rising corporate frauds and scams, the government set up a Committee on Corporate Governance under the Chairmanship of Shri Naresh Chandra, former Cabinet Secretary. The Naresh Chandra Committee inter-alia recommended setting up of the Serious Fraud investigation Office (SFIO). The organisation has been established in 2003.

Key highlights of the SFIO

Insights – SFIO: Will hold you by your (White) Collar!

| Year | Corporate house | Charges | The SFIO Investigation |

|---|---|---|---|

| 2012 - present | Kingfisher group | Money laundering; financial irregularities; wilful default on account of non-repayment of approximately Rs. 9,000 crores borrowed from a consortium of Banks. | Investigating Kingfisher Airlines for financial irregularities and fund diversion since September 2015. It is also looking into Kingfisher Airlines' brand valuation on the basis of which loans may have been extended to the company.1 |

| 2010 - present | Sahara group | Sahara Group was accused of failing to refund over Rs. 20,000 crore to its more than 30 million small investors which it collected through two unlisted companies of Sahara.u00a0Such issue was not in compliance with the requirements applicable to the public offerings of securities. | |

| 2014 - present | Saradha Chit Fund | Around Rs. 200 to 300 billion from investors with a promise of high returns for their investments. The company which enjoyed strong political backings collapsed in April 2013. The amount investors lost is estimated to be between Rs. 2060 - 2400 crores. | The SFIO investigation into 14 Saradha group firms concluded that the companies have been found to be running 'ponzi schemes' and would face prosecution for violation of several laws including the Chit Fund act, thee Companies Act, IPC etc. |

| 2012 | Reebok India | Commercial irregularities to the tune of 870 crores came to light. The senior management was under the scanner for misappropriation of funds, inventory diversion and inflation of sales. | The SFIO charge sheeted the senior management involved in the irregularities and also found dissatisfactory the investigation by the audit firm. |

| 2009 | Satyam Computers | The promoter admitted to inflating the company revenue, profit and profit margins for every single quarter over a period of 5 years, from 2003-2008. The amount embezzled was estimated to be around Rs. 7,200 crore. | The SFIO completed its investigation with a record 3 months. The report submitted severely indicted the auditors and held that the independent auditors were mere spectators. This along with independent investigations carried out the CBI and the Enforcement Directorate resulted in conviction and arrest of the promoters. |

Insights – SFIO: Will hold you by your (White) Collar!

The SFIO struggle

The SFIO was established as premier, one stop shop investigating agency of the government to detect, investigate and prevent frauds in the Indian corporate world. However, their track record of investigation can be far better than it currently is. While it investigated the above cases especially the Satyam case and the Reebok case at breakneck speed, there have been substantial delay in other cases. This is not very reassuring to the investor at a time when instances of insider trading, financial inflation and related frauds are on the rise. There seem to be many factors contributing to this oxymoron situation. The biggest challenge seems to be manpower. For a multi-disciplinary agency, recruitment of the credible professionals is a challenge. The Rules for such recruitments are not objectively defined.

Additionally, being under the jurisdiction of the Central Ministry the SFIO is dependent on the directions provided by the Department. The SFIO can investigate only when the MCA directs for an investigation and subsequent prosecution. Also the SFIO’s role is to detect fraud rather than prevent it. Therefore, it is essential to also device checks and balance to unearth a possible fraud at an earlier stage. Therefore, in an effort to identify fraudulent activities at an early stage, Market Research & Analysis Unit (MRAU) of SFIO has been established. This wing analyses information in public domain as well as inputs received from various other sources. In house forensic labs of MRAU have been set up to investigate digital data.

The end result

The basic human emotions of greed, power and intention lies at the bottom of these scams and scandals. The challenges have become manifold now with technology aiding such intentions. Agencies such as the SFIO have been created primarily to detect, investigate bring to book the perpetrators. However, a more resources and power have to be given to such agencies to perform to their maximum potential.

Source:

Circulars & Notifications

MCA

NCLT (Amendment) Rules, 2017 dt. 05.07.2017

Companies (Appointment & Qualification of Directors) Rules, 2017 dt. 30.06.2017

Notification dt. 05.07.2017 on Amendment to Schedule IV of Companies Act, 2013

SEBI

Cir. dt. 30.06.2017 on ISINs for Debt Securities

Cir. dt. 30.06.2017 on Acceptance of e-pan for KYC purpose

Cir. dt. 30.06.2017 on Monitoring & Reviewing CRAs

Cir. dt. 03.07.2017 on Annual Inspection by Stock Exchange

Cir. dt. 04.07.2017 on Investments by FPIs in Government Securities

Cir. dt. 06.07.2017 on Online filing for Foreign Venture Capital

Cir. dt. 07.07.2017 on Guidance for issuance of ODIs

FEM

Notification dt. 23.06.2017 on FEM (Export of Goods & Services) Regulations, 2017

Notification dt. 03.07.

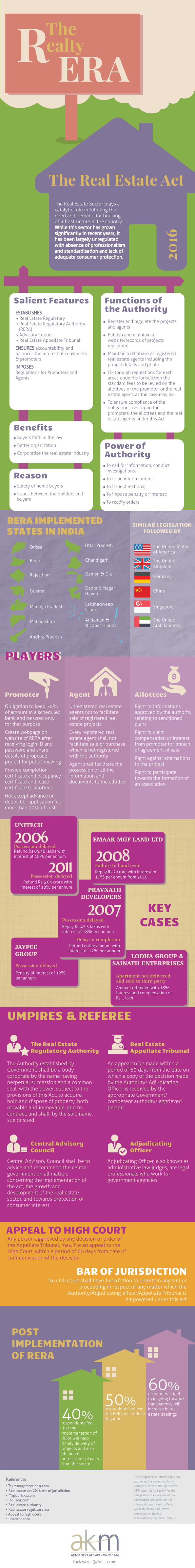

Infographic

Lawlipop

Justice is ‘the crowning glory’, ‘the sovereign mistress’ and ‘the queen of virtue’

Cicero

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He holds a Bachelor’s and Master’s Degree in Corporate Secretaryship and a Degree in Law. He is a Fellow member of the Institute of Company Secretaries of India and an Associate Member of the Corporate Governance Institute, UK and Ireland. He has also completed a program from ISB on ‘Value Creation through Mergers and Acquisitions.

He has over 18 years of experience in both litigation and advisory practice. He specializes in all aspects of Corporate Law with a complete focus on Mergers and Acquisitions, Insolvency and Bankruptcy, Contracts etc.,

He conceptualized and created www.IBCcases.com, India’s first unique, exclusive and now the most exhaustive Research Engine on the ‘Law of Insolvency and Bankruptcy’. IBCcases.com was launched by Dr M.S. Sahoo, Chairperson of the ‘Insolvency and Bankruptcy Board of India’.

He has co-authored a unique book published by Lexis Nexis titled ‘Supreme Court on Insolvency and Bankruptcy Code’, which is a consolidation of a section-wise analysis of all decisions of the Supreme Court.

Mr Suman is a member of the Governing Council of the Indo-Japan Chamber of Commerce, focusing exclusively on trade between India and Japan. He was instrumental in completing an economic survey on ‘Indian Industry expectations from Japanese Companies in Tamil Nadu’.

Mr Suman and his Firm are actively engaged in the international arena to attract foreign investments into India. Mr Suman has organized several India-focused Webinars with the United Nations Industrial Development Organization, ITPO Tokyo. He also organized and completed a unique ‘Issue resolution summit’ for foreign companies and successfully resolved issues on fast-track mode with the support of the Central Government and the State Government of Tamil Nadu.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

Mr P Muthusamy is an Indian Revenue Service (IRS) officer with an outstanding career of 30+ years of experience and expertise in all niche areas of Indirect Taxes covering a wide spectrum including GST, Customs, GATT Valuation, Central Excise and Foreign Trade.

His expertise also extends to Trade Related Intellectual Property Rights (TRIPS), Joint ventures/Collaborations especially in Related company valuation and related party transactions, Indirect Tax Advisory, Tax Compliance, Foreign Trade Advisory and IP Management.

He has a super specialization in sectors such as Health, Construction, Automotive, Pharmaceuticals, Agriculture, STEM, Information Technology, Transport and e-Commerce.

He served in various capacities as AO/AC/DC/JC with distinction in Tamil Nadu and Andhra Pradesh reaching the position of ‘Commissioner-Central Excise, Customs and GST’ during which he adjudicated a large number of cases related to the above areas.

During his stint in Tamil Nadu, he held senior positions including Head of Office, and Head Central intelligence unit and vigilance wing, Director of National Academy of Customs, Excise & Narcotics and Systems Manager of the Commissionerate during the implementation of Automation of Central Excise and Service Tax (ACES) and ICES 1.5.

While in Andhra Pradesh, he took on the challenging task of leading the GST implementation team, supervising, and controlling the administration of Tirupati, Vizag and Kakinada GST formations.

As the Zonal Unit Approval Committee Member, he approved number of SEZs and 100% EOU Units in MEPZ, STPI, Mahindra City SEZ, SRI City and Vizag SEZ’s.

He graduated with a degree in Agriculture and then went on to get his Law Degree and has a Masters in Management Systems from BITS, Pilani. Mr. Muthusamy is academically trained in the e-governance of revenue collection conducted by BITS Pilani, Special intelligence course for Revenue Officers (SICO) conducted by the Cabinet Secretariat, Gurgaon. Mid-Career Training Program of IRS (C&CE) Officers, Phase 4 by NACEN, Faridabad, IIM, Lucknow, London School of Economics, Cambridge University, UK and Nyenrode Business School, Amsterdam and Rules of Origin, Green Customs, IPR Implementation by WCO.

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

During his judicial role, he heard and decided a large number of cases, including some of the most sensitive, complicated, and high-stake matters on insolvency and bankruptcy, including many cases on resolution plans, shareholder disputes and Schemes of Amalgamation, De-mergers, restructuring etc.,

Some of the important cases dealt with by him are the Jet Airways case, Veer Gurjar Aluminum Industries, Innoventive Industries, Kirusa Software and the Tata Sons v. Cyrus Investments case.

Before joining the NCLT, he held important positions in the Madras High Court for 23 years in various capacities such as the Assistant Registrar (Insolvents Accounts) – Original Side admitting plaints, the Deputy Registrar – Judicial side supervising all Judicial Sections of the Registry, the Deputy Registrar (Administration), Co-ordinator of the High Court’s Mediation Centre, Joint Registrar. Finally, he acted as the Official Assignee of the High Court of Madras, administering Insolvency Estates for over four years.

Mr Nallasenapathy is presently a practising lawyer and a Partner at A.K. Mylsamy and Associates LLP. He advises clients on various corporate matters and represents clients before NCLT’s, NCLAT’s, High Courts and the Supreme Court.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

Ms. Sarah Abraham has been enrolled with the Bar Council of Tamil Nadu since 1998. Her areas of practice include Shareholder Disputes, Corporate Compliances, Mergers and Acquisitions, Private Equity/ Venture Capital Agreements and allied disputes, Information Technology Contracts, Intellectual Property, General Commercial Agreements, Litigation, Arbitration and Mediation.

She holds a post graduate degree in Business Laws from National Law School of India University (NLSIU) (MBL) and a bachelor’s degree from Symbiosis Law College, Pune (LLB). In addition, she holds a second bachelor’s degree in Commerce (B.Com).

She is professionally trained in mediation by Singapore Mediation Centre (under the aegis of the Singapore Supreme Court) and is an MCPC certified mediator (Mediation and Conciliation Project Committee under the auspice of the Hon’ble Supreme Court of India). She is associated with Tamil Nadu Mediation and Conciliation Centre (TNMCC), annexed to the Hon’ble High Court of Madras.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

A K Mylsamy is the Founder, Managing Partner and the anchor of the firm. He holds a Degree in law and a Degree in Literature. He is enrolled with the Bar Council of Tamil Nadu.

With over 53 years of standing at the Bar, he is known for his professional integrity and expertise in corporate and civil law.

He heads the litigation and arbitration practice of the Firm and regularly appears before various High Courts, the National Company Law Tribunals, the National Company Law Appellate Tribunal and the Supreme Court. He specializes in civil and commercial litigation with specific focus on shareholders litigation and the Insolvency and Bankruptcy practice of the Firm.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

M Subathra holds a Degree in law and a Master’s Degree in International Business Law from the University of Manchester, United Kingdom. She is enrolled with the Bar Council of Tamil Nadu.

She also holds a Degree in fine arts and is the creative brain of the Firm. She manages the Firm and handles the ‘The Law Tree’ which is the Firm’s legal monthly newsletter.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

Mr. K Rajendran is a former Indian Revenue Service (IRS) officer with a distinguished service of 35 years in the Indirect Taxation Department with rich experience and expertise in the fields of Customs, Central Excise, Service Tax and GST. He possesses Master’s Degree in English literature. Prior to joining the Department, he served for the All India Radio, Coimbatore for a period of about 4 years.

He served in various capacities and in various parts of the Nation including Tamil Nadu, Karnataka and Andhra Pradesh. As Assistant Director in the National Academy of Customs, Excise and Narcotics (NACEN), Bangalore, he enthusiastically conducted classes on Customs, central Excise, Service Tax and Narcotics control to the Departmental Officers of various grades belonging to the entire State of Karnataka. At the time of launch of Goods and Service Tax, he had undertaken the task of training the Departmental Officers of both the State and Central Governments on the complex legal provisions of GST. The Officers of both the Governments fondly recognize him as the Guru and constantly in touch with him for seeking clarifications on tax matters. With his rich experience and expertise, he had taken enormous interest for the implementation of Automation of Central Excise and Service Tax (ACES).

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

An MBA from the Indian Institute of Management, Calcutta, and an M.Sc. in Tourism Management from the Scottish Hotel School, UK, Ashok Anantram was one fo the earliest IIM graduates to enter the Indian hospitality industry. He joined India Tourism Development Corporation (ITDC) in 1970 and after a brief stint proceeded to the UK on a scholarship. On his return to India, he joined ITC Hotels Limited in 1975. Over the 30 years in this Organisation, he held senior leadership positions in Sales & Marketing and was its Vice President – Sales & Marketing. He was closely involved in decision making at the corporate level and saw the chain grow from a single hotel in 1975 to a very large multi-brand professional hospitality group.

During his stint at ITC hotels, he also headed the Human Resource & Training function as Vice President – Human Resources. Ashok Anantram represented the company at several interactions with Government and Industry Associations on Tourism and Hospitality. He also held key positions in tourismindustry bodies.

He has a passion for teaching and has been faculty at numerous programs related to marketing and hospitality, including the Department of Marketing, University of Strathclyde, UK where he taught Sales & Marketing in their MBA program.

Following his retirement in 2003, he moved to Chennai and was President – Business Development at Apollo Hospitals Ltd. Currently he is a Consultant in good marketing and strategy to several Organisations.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Mani holds a Bachelor Degree in Science and P.G. Diploma in Journalism and Public Relations. He has a rich and varied experience of over 4 decades in Banking, Finance, Hospitality and freelance Journalism. He began his career with Andhra Bank and had the benefit of several training programs in Banking.

Later on, he became the Group CEO of the M.R. Kodandaram Group [a part of the M.S. Ramiah Group, Bangalore] in respect of a 5 Star Hotel and their Chemical and Bio Technology ventures. As the CEO, he successfully completed the construction of the hotel and also managed its operations.

He has contributed to several columns of the New Indian Express newspaper on issues relating to Personal Finance.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Mr. Kailash Chandra Kala joined the Department of Revenue, Ministry of Finance as ‘Customs Appraiser’ at Mumbai in the year 1993.

Served at different Custom Houses namely New Custom House Mumbai, Air Cargo Complex Import Commissionerate, JNCH Nhava Sheva. As Assistant Commissioner, posted to Jamnagar Customs and during 2006 to 2010 served as Deputy Commissioner at Nhava Sheva.

Served as Joint Commissioner in Pune Customs and as an Additional Commissioner in Pune Central Excise. In 2018, went for Mid Career Training Programme (MCTP) to United Kingdom, Belgium and Netherland.

Served as Additional Commissioner at GST, Navi Mumbai & at Mumbai Customs JNCH and in ACC in Export Commissionerate.

Mr.R.Sekar, Indian Revenue Service (R) of 1984 batch was formerly Joint Secretary (Tax Research Unit), Department of Revenue, Ministry of Finance, Government of India and retired as Principal Commissioner in the year 2016.

Mr.Sekar served in the policy making body of the Central Board of Indirect Tax (Tax Research Unit) during the period 1991 to 2008 at various capacities and associated with making of 15 Union Budgets.

His assignments include

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

S Ramanujam, is a Chartered Accountant with over 40 years of experience and specialization in areas of Corporate Tax, Mergers or Demergers, Restructuring and Acquisitions. He worked as the Executive Vice-President, Group Taxation of the UB Group, Bangalore.

He is a Specialist Editor of the Ramaiya’s Guide to the Companies Act, 17th Edition. He has authored a popular commentary on Mergers and Acquisition known as ‘Mergers et al’ [released in 2011 with the third edition being the latest] and the book ‘Brands Costs, Concepts and Case Studies’.

He is a faculty member of the Institute of Chartered Accountants of India, Institute of Costs and Works Accountants of India, Institute of Company Secretaries of India, Institute of Chartered Financial Analysts, visiting faculty at the Indian Institute of Management, Bangalore, National Law Schools, etc.,

He devotes substantial time in the academic field, associating with faculty members and enriching the career orientation of students. He has delivered many lectures and presented papers in conferences and is a regular contributor to the Hindu and the Business Line.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

K K Balu holds a degree in B.A and B.L and is a Corporate Lawyer having over 50 years of Legal, Teaching and Judicial experience.

He has obtained training in India and Abroad on matters relating to Banking, Housing, Micro-Finance and Tax planning. He held senior positions in the National Housing Bank and Syndicate Bank between 1978 and 1996 and was a Legal Advisor for various Banks while practicing law.

He is the Former Vice-Chairman [judge] of the Company Law Board which position he occupied for over 12 years and has over 500 reported cases to his credit. He resumed his legal practice in 2009.He acts as an Arbitrator, Conciliator and Mediator.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Justice M. Jaichandren hails from an illustrious family of lawyers, academics and politicians. Justice Jaichandren majored in criminology and then qualified as a lawyer by securing a gold medal. He successfully practiced in the Madras High Court and appeared in several civil, criminal, consumer, labour, administrative and debt recovery tribunals. He held office as an Advocate for the Government (Writs Side) in Chennai and was on the panel of several government organizations as senior counsel. His true passion lay in practicing Constitutional laws with focus on writs in the Madras High Court. He was appointed Judge, High Court of Madras in December 2005 and retired in February 2017.

Besides a stellar legal career spanning nearing four decades, Justice Jaichandren was and is actively associated with several educational, social, cultural and service associations / organizations. The academic in him shines bright. While he is a teacher at prestigious legal institutions, he is also a student pursuing post-doctoral research in Law, University of Madras. Not only has he participated in several legal conferences and seminars, he has judged several moot court competitions and put together team(s) that would represent Indian legal talent internationally. His passion for human rights and environment protection saw him filing public interest litigations of importance.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

S Balasubramanian is a Commerce and Law Graduate. He is a member of the Delhi Bar Council, an associate Member of the Institute of Chartered Accountants of India, the Institute of Company Secretaries of India and Management Accountants of India.

He initially joined the Indian Postal Service in 1966 through the Civil Service Examination. Thereafter, he became a member [judge] of the Company Law Board on its initial constitution in the year 1991 a position he occupied for a period of 19 years.

He was also the Chairman of the Company Law Board for over 12 years and has dealt with over 3000 cases and has over 600 reported cases to his credit. One of the landmark cases dealt by him was Satyam Computers Ltd, which due to his pro-active and timely decisions/orders was revived within a short period of 6 months.

He is a General Editor of the ‘Ramaiya’s Guide to the Companies Act, 2013’ and was the Chairman of the Editorial Board of the magazine ‘Chartered Secretary’ for 10 years.

He is also an Arbitrator and handles Arbitrations. He has 50 years of immense experience and expertise in Corporate Law.

I ACKNOWLEDGE HAVING READ THE DISCLAIMERS IN DETAIL AND AGREE TO THE SAME

DISCLAIMERS & USER ACKNOWLEDGEMENT

By subscribing to the Newletter, I explicitly acknowledge each of the following:

(a) I voluntarily wish to subscribe to the Newsletter after having read and acknowledging all Disclaimers on the newsletter and on the website,

(b) I desire to have updates and knowledge from A.K. Mylsamy & Associates LLP [‘AKM’] for my own information and use,

(c) there has been no solicitation, invitation or inducement of any sort whatsoever from A.K.M or any of its members to create an Attorney-Client relationship through the Newsletter or the website.

(d)The Newsletter is for AKM’s private circulation only and forward transmission or further dissemination of the same for any reason whatsoever is not permitted.

A.K. Mylsamy & Associates LLP [‘AKM’] provides this Website [www.akmllp.com] and/or the Newsletter [The Law Tree’] as a resource purely for informational purposes only and these shall not be construed under any circumstances as, (a) soliciting or advertisement of any nature whatsoever; (b) as legal/professional advice, circular or other basis for advertisement, personal communication, an invitation to tout etc.,. (c) constitution or creation of a Attorney-Client relationship by reason of the transmission, receipt or use or otherwise of the contents thereof.

The Website, Newsletter etc., is intended, but not guaranteed or warranted to be complete, correct and up-to-date. AKM assumes no liability for the interpretation and/or use of the information contained on this website, nor does it offer a warranty of any kind, either expressed or implied. AKM hereby disclaims any and all liability to any person/entity for any loss or damage caused by errors or omissions, whether such errors or omissions result from negligence, accident or any other cause such as but not limited to any inaccuracy, defect etc., which may have inadvertently crept in due to third party information or otherwise. You confirm that you will not act, or refrain from acting, based solely upon any or all of the contents of this Website or Newsletter.

This website does not intend links from this site to other websites to be referrals to, endorsements of, or affiliations etc., and AKM is not responsible for, and makes no representations or warranties about, the contents of such linked websites.